Glossary

Here are explanations of terms and abbreviations used in our commentary and charting

TradeCheck

Use our TradeCheck form to get the latest analysis on a particular code/index/forex. We'll get back to you usually within the hour. (Business hours, Sydney, Australia time)

Robo Method

A mechanical trading system that has clear entry stop and trade management.

The real beauty of this method is that it keeps you on the right side of the market; it tracks the direction and helps manage the risk. We use it for intraday trading, short term, trend and managing portfolios.

There is a basic version and an advanced version.

We use Daily Robo, Hourly Robo, 2 Minute Robo and so on. They are used daily in our service and will be taught to you as part of our service.

Switch Trading System

Is a very high probability market entry system use in all trading time frames

This is taught to you along with other trading techniques with the service

Accumulation: purchase of stock over time –

Phase 1 of the buying process

Phase 2 is the marketing up of prices to attract public

Phase 3 Distribution selling into the expanding volume

Phase 4 marking down driving price down

Supply: Resistance/ sellers

Scaling: breaking down initial position size into smaller parcels to manage the risk better, gaining more control.

Using levels as stops:

If you're entering a long position into a market above a Major TradingLevel with the classic set up, then place the stop directly under the Major TradingLevel, also understand the MinorLevels surrounding the Major or MediumLevel’s as they will come into play. The Market Depth orders are also a further refinement

If you are already in a trade and its moved up through a MediumLevel and its coming back to retest the MediumLevel then you need to give it room to move, you cannot for instance place the stop at the MediumLevel as you will only trigger that stop and you may as well get out before that happens. You need to consider the levels under the MediumLevel as stops, if you feel carrying that much financial risk is out of your financial risk parameters then reduce the position size or simply exit from the market. Markets tend to vibrate around the levels this needs to be considered with your own judgement.

Essentially you shouldn’t move stops unless the next level of support has been tested. Otherwise if you are using the Robo Method, and still using the Minor and Sub Minor Levels along with the Market Depth this can deliver better results.

Guides to our Analysis Concepts

Guide to the TradingLevels®

Five main levels groups:

1.Major TradingLevels

Abbreviated as (TL)

1, 2, 3, 5, 8, 10, 13, 20, 30, 50, 80, 100… and so on

As an example TL1/1, TL1/100, TL2/2, TL2/20, TL3, TL5, TL8, TL13

2.MediumTradingLevels

Abbreviated as (ML)

1.5, 2.5, 4, 6.5, 9, 11.50, 15, 16.50, 25, 40, 65, 90, 150… and so on

As an example ML150, ML250, ML4, ML650, ML9, ML1150, ML15, ML1650, ML25….

3.Minor TradingLevels

Abbreviated as (mTL)

0.1,0.2,0.3,0.5,0.8,1.1,.1.2,1.3,1.5,1.8,2.1… and so on

As an example mTL1, mTL2, mTL3, mTL5, mTL8

4. Sub Levels

Abbreviated as (sTL)

As an example: sTL1/$20.10, sTL2/$20.20, sTL3/$20.30, sTL5/$5.50, sTL5/$0.65, sTL72/ $0.72, sTL8/$0.80 … and so on

5. TradingLevel 72

Abbreviated as (72)

A) $0.072, $0.72, .72, $7.20, $72, $720, 7200pts…. and so on

B) $1.72, $2.72, $3.72, $4.72, $5.72, $6.72, $7.72, $8.72, $9.72, $10.72… and so on

C) Trading Indices 5072, 5172, 5272, 5372 so on...

D) Day Trading between One Dollar $35.72, $36.72...

E) Day Trading Forex 0.7872...

Example of TradingLevels formula together

When working on say, the price of 18, which is partly: TL1/10 and a Minor TradingLevel (that’s 0.08) then working together its written as mTL8.

The TradingLevels® Formula also includes some special number groupings:

TradingLevel MinorGroup1

Abbreviated as (MG1)

are the MinorLevels 1,2 and 3. Two examples would be say MajorTradingLevel1 TL1/ $1.00 and MinorGroup1 would then be $1.10, $1.20 and $1.30.

If it was TL2/20 then MinorGroup1 would be MG1/$21, MG2/$22 and mTL3/$23

TradingLevel SubGroup1

Abbreviated as (SG1)

SubGroup 1 is made up of the SubLevels 1,2 and 3. Two examples would be say Minor TradingLevel mTL2 $22.00 and SubGroup1 would then be $22.10, $22.20 and $22.30.

If it was TL5/50 then SubGroup 1 would be $51.10, $51.20 and $51.30

TradingLevel MinorGroup2

Abbreviated as (MG2)

are the numbers 65, 72 and 80. As an example $1.65, $1.72, $1.80.

TradingLevel SubGroup2

Abbreviated as (SG2)

SubGroup 2 is also the numbers 65, 72 and 80

Two examples would be say Minor TradingLevel mTL2 $22.00 and SubGroup2 would then be $22.65, $22.72 and $22.80.

If it was TL5/50 then SubGroup 2 would be $51.65, $51.72 and $51.80

NOTE: Charts show Support & Resistance

Abbrevieated by (S/P)

There are examples of these in the »TradingLevels Fast Track Intro and »Online Courses

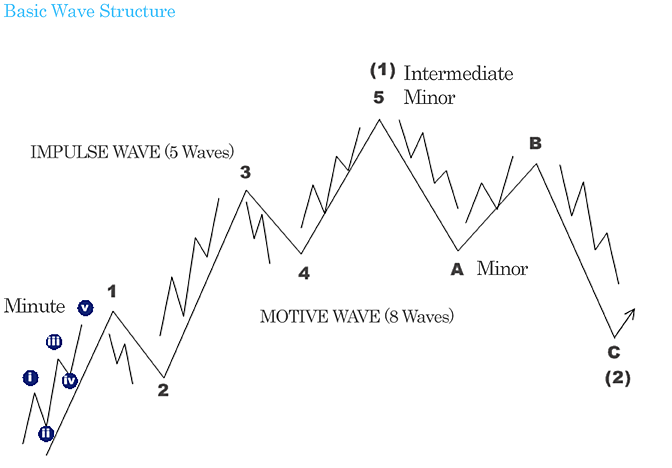

Guide to Elliott Wave

Degrees of Elliott Wave Structure

Submicro (1) (2) (3) (4) (5) (A) (B) (C) Size 10 colour Olive

Micro 1) 2) 3) 4) 5) A) B) C) Size 10 colour Steel Blue

Subminuette i ii iii iv v a b c Size 10 colour Black

Minuette (i) (ii) (iii) (iv) (v) (a) (b) (c) Size 10 colour Dark Green

Minute Wave i) ii) ii) iii) iv) v) a) b) c) size 12 colour Midnight Blue

Minor Wave 1 2 3 4 5 A B C Size 14 colour Dark Slate Grey

Intermediate Wave (1) (2) (3) (4) (5) (A) (B) (C) size 14 colour Midnight Blue

Primary Wave 1) 2) 3) 4) 5) A) B) C) Size 16 colour Deep Sky Blue

NOTE:

The wave numbers/ text with a half bracket represents full circles

The colouring is just my thing to help with identification.

Watch this VIDEO» to get an even clearer understanding!

Guide to Our Main Strategies

These videos are available only when you have Membership Access.

If you're not a Member you can »Trial our Service for 1 Month

BACK TO TOP»

|

|

|

|

|

|

|

|

|

|

|

|